The Inconvenient Truth

How not to be stupid about the economy when you consider who to vote for ...

Introduction

Economic indicators like interest rates and inflation are often used to judge the performance of a country’s administration. The Trump Campaign is making a big deal about the high inflation rate and high interest rates in a cynical attempt to frighten their base and secure additional votes with the claim that only The Donald can fix such things. What adherents to this view point miss is that these kinds of metrics are not merely the product of domestic policy decisions; they are deeply intertwined with global economic forces that no single administration can control.

Our modern economy is highly interconnected, with cross-border trade, investment, and technological advancements creating a web of dependencies that shape national economic outcomes. The United States, while a major player, is not immune to these global dynamics. For instance, supply chain disruptions in Asia, energy price fluctuations in Europe, or policy shifts by central banks in other major economies can significantly impact inflation and interest rates domestically. Judging an American administration solely on these economic outcomes ignores the fact that many of these forces are beyond the direct control of national leaders. Understanding the global context is crucial to avoid misattributions of blame or credit.

While domestic policies certainly play a role in shaping economic conditions, they are often just one part of a larger equation. Even well-crafted fiscal and monetary policies can be overwhelmed by external shocks such as pandemics, international conflicts, or shifts in global trade dynamics. For example, the inflationary pressures that the world experienced in the wake of the COVID-19 pandemic were not the result of any single country's policy but were a consequence of global supply chain breakdowns, pent-up consumer demand, and unprecedented government spending worldwide. When administrations are judged against such phenomena, it underscores the limitations of national policies in countering global economic tides.

To fairly assess the economic performance of any administration, it’s essential to look beyond domestic actions and consider how international factors influence national outcomes. It is an oversimplification to hold a single administration accountable for global economic trends, especially in an era marked by deep interconnectivity. By adopting a broader perspective, we can better appreciate the complexities at play and evaluate administrations not by the presence of inflation or interest rate fluctuations alone but by how effectively they navigate these global challenges. Ultimately, understanding the broader landscape helps us avoid the folly of placing undue blame or praise based solely on economic conditions largely shaped by forces far beyond any national leader’s control.

What The Data Says

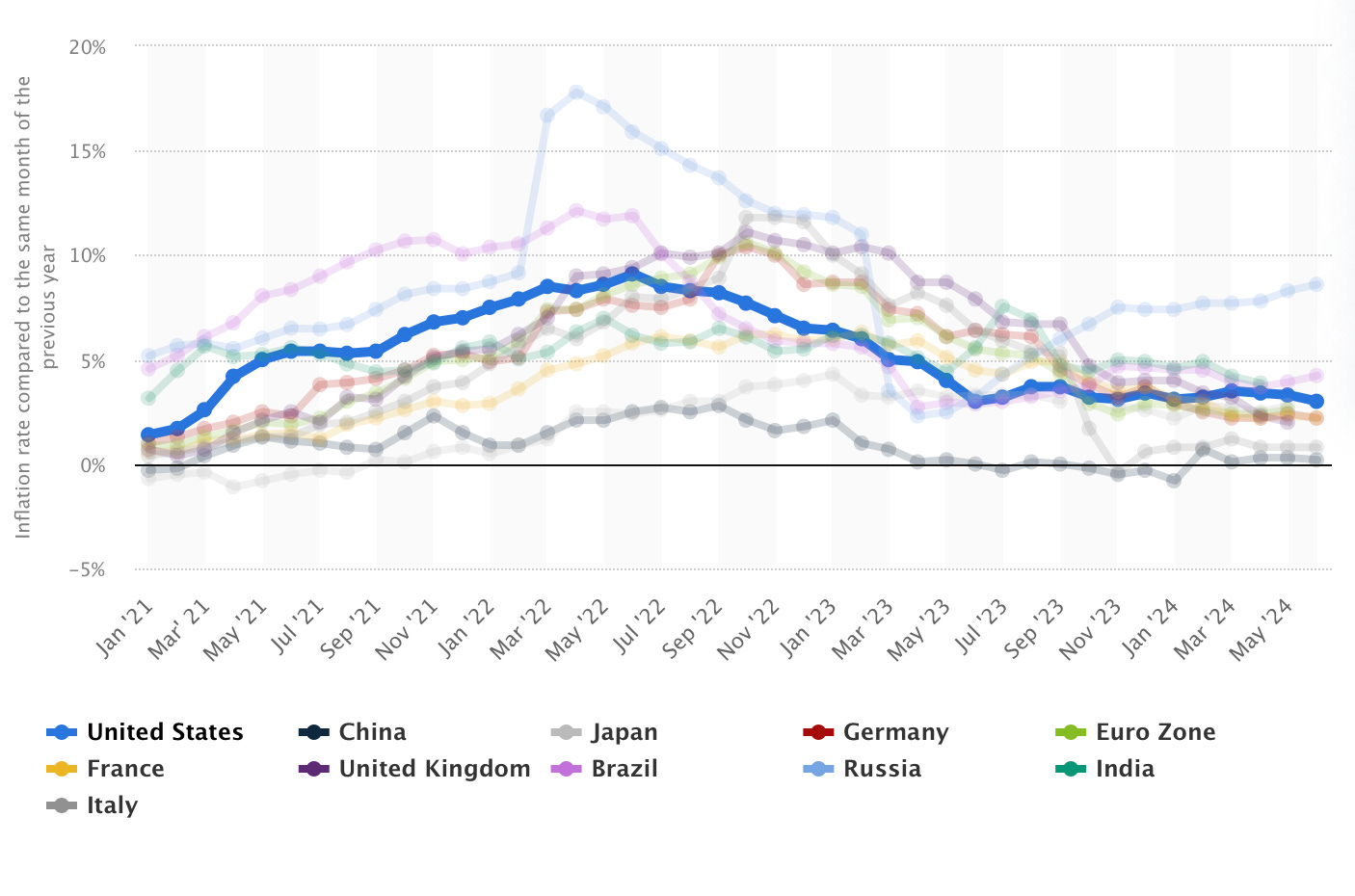

Let’s consider that from 2021 to 2024, domestic inflation in the United States surged to levels not seen in decades, prompting significant concern among consumers, businesses, and policymakers alike. Prices for everyday goods and services, from groceries to gasoline, increased sharply, leading to a tangible erosion of purchasing power for many Americans. At first glance, this inflationary spike seems to provide compelling evidence for those arguing that the Biden/Harris administration's policies—such as expansive fiscal spending and regulatory changes—played a significant role in driving up prices. The narrative that the administration's actions directly fueled inflation resonates with many who experienced the strain of rising costs during this period.

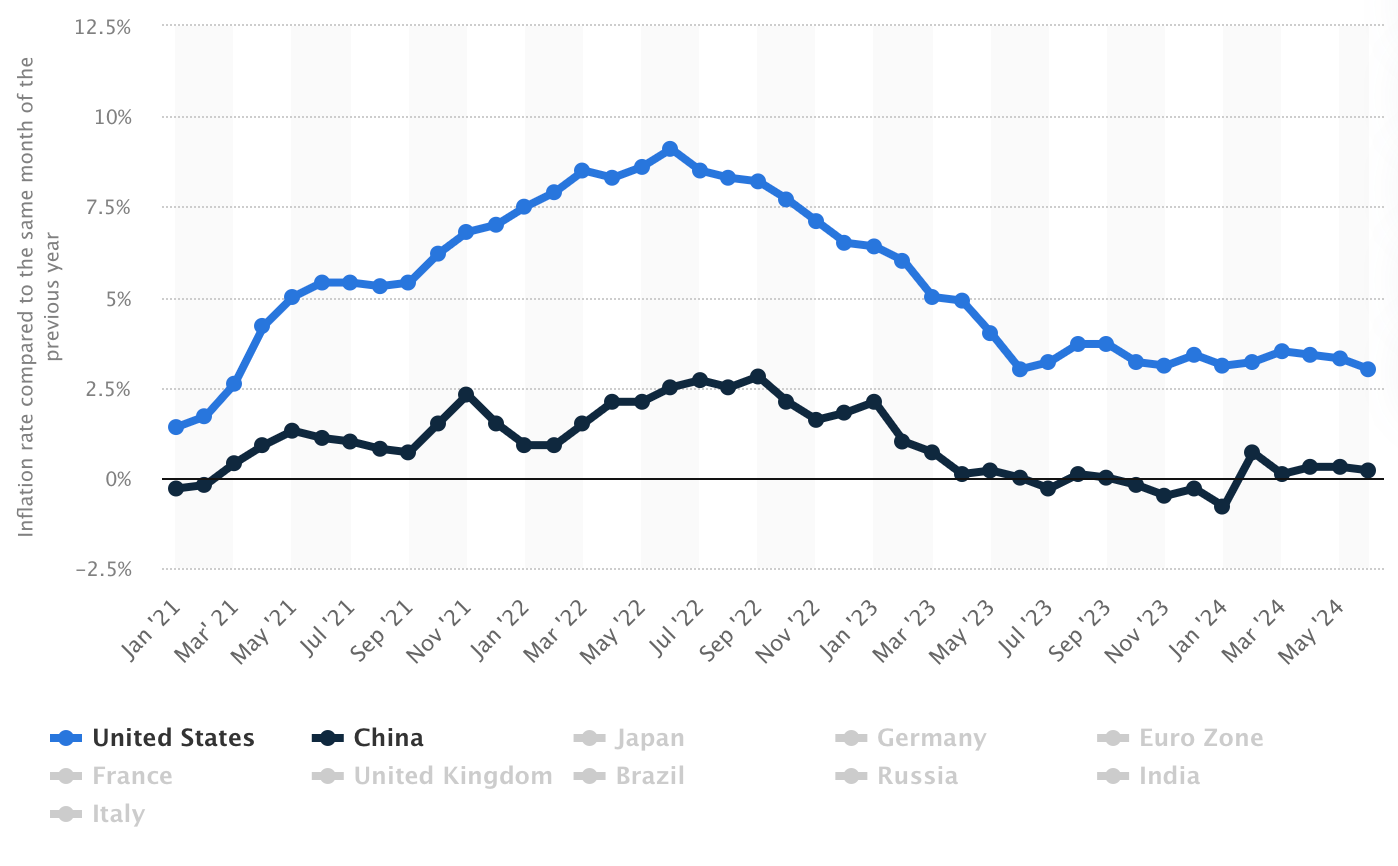

However, while these factors certainly influenced inflation, the broader economic context and global forces at play complicate this assessment, making it crucial to look beyond surface-level conclusions when attributing the causes of high inflation rates. Let’s consider our inflation issues with those of Communist China.

While it’s true that the United States could have potentially curbed inflation more effectively by adopting some of the stringent economic measures used by Communist China—such as strict price controls, aggressive central planning, or harsh lockdown policies—the trade-offs would have been profound. China's approach to managing its economy often prioritizes stability and control over individual freedoms, with citizens having little say in economic policy decisions or personal financial choices.

In contrast, the U.S. economic system, despite facing higher inflation, offers far greater personal and economic freedoms, allowing individuals to make choices about their work, investments, and lifestyle. Furthermore, the average American still enjoys a substantially higher standard of living compared to the average Chinese citizen, with greater access to consumer goods, better wages, and more economic mobility. While inflation may be a significant concern, the relative economic outcomes and freedoms afforded by the U.S. system underscore the value of a market-driven economy, even amidst economic challenges. Balancing economic management with the preservation of personal freedoms remains a core tenet of the American system, differentiating it fundamentally from more authoritarian economic models.

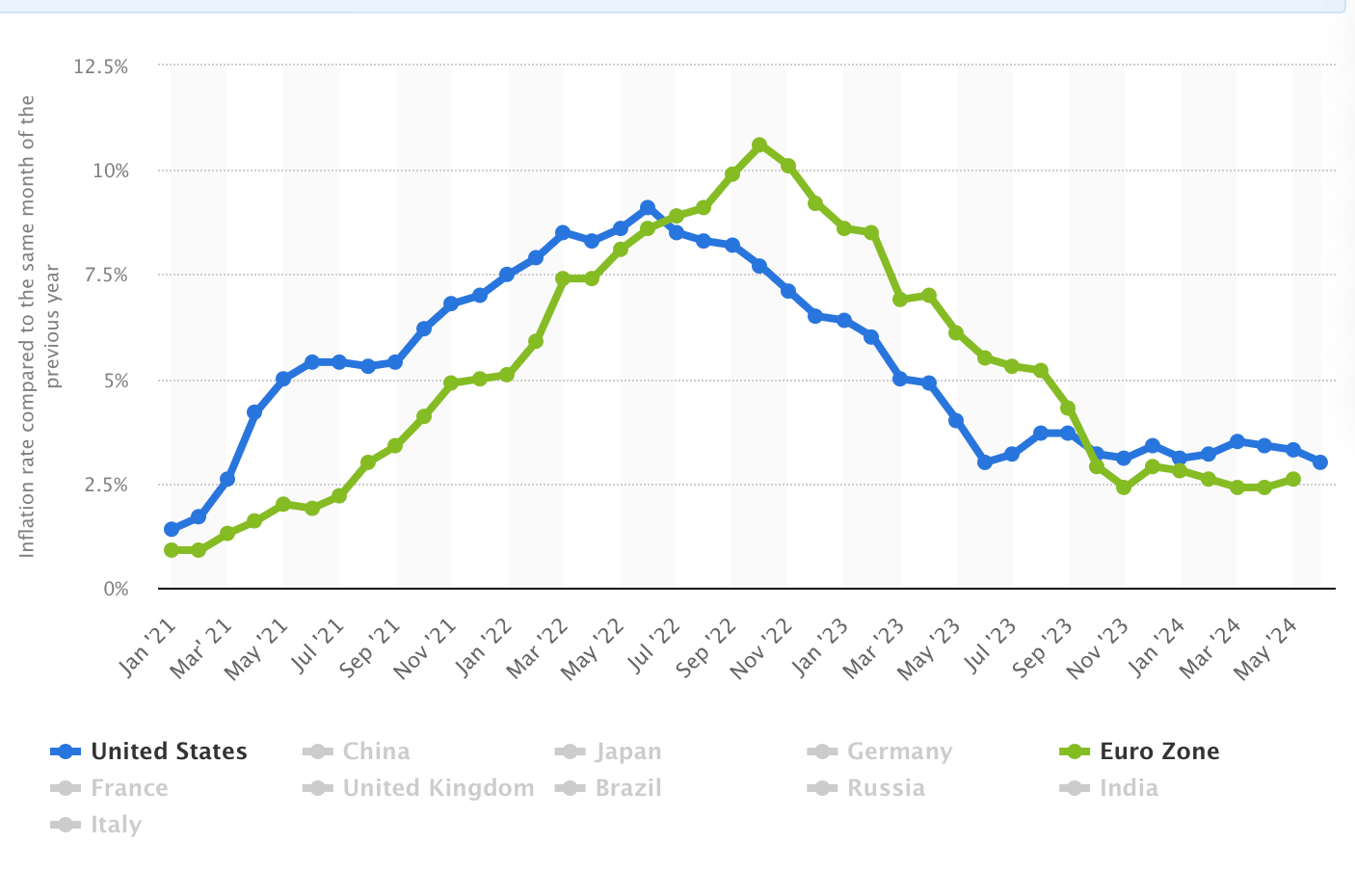

This comparison raises the question: how did the United States fare against the Eurozone in terms of inflation during the same period? Notably, President Biden was not in charge of any country within the European Union, making it clear that American domestic policies were not driving inflationary pressures across the Atlantic. The Eurozone, like the U.S., faced its own significant inflation challenges from 2021 to 2024.

These inflationary pressures were widely acknowledged to be driven by factors such as energy price spikes, supply chain disruptions, and the economic aftermath of the pandemic. Inflation rates in many European countries reached levels that mirrored or even exceeded those in the United States, underscoring that inflation was a global phenomenon rather than a uniquely American problem. This comparison highlights that attributing high inflation solely to U.S. domestic policies, such as those implemented by the Biden administration, overlooks the broader context of worldwide economic disruptions. It seems highly unlikely that American policies alone could have triggered inflationary pressures in the Eurozone, pointing instead to shared global challenges that impacted economies around the world.

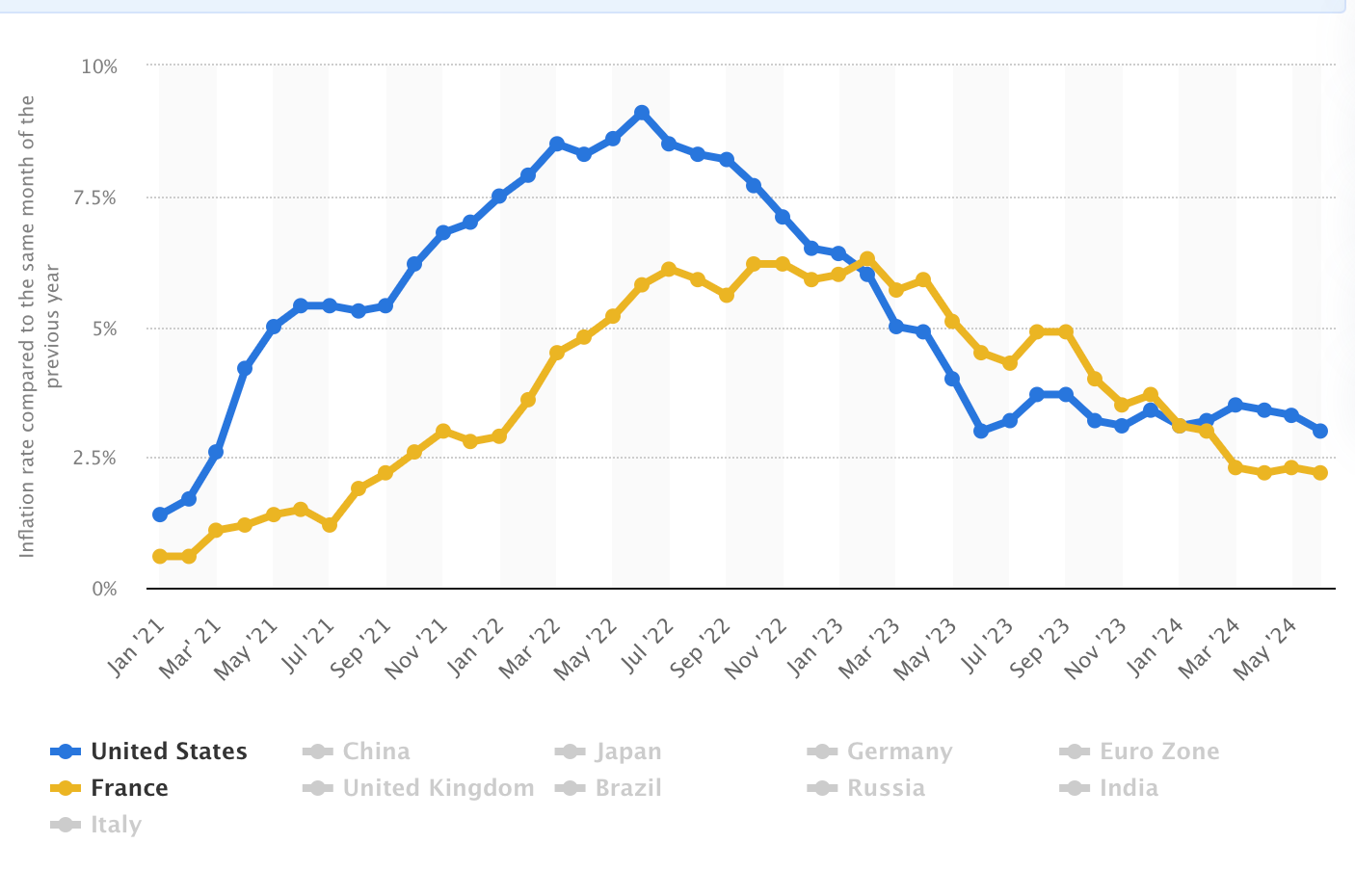

Of course we still have to talk about France.

France managed to escape the peaks the inflationary pressures that hit much of the world from 2021 to 2024 due to a combination of unique policy measures and structural economic factors. One of the key differences was France’s heavy reliance on nuclear energy, which provided a stable and relatively low-cost energy supply at a time when other nations, particularly in Europe, were grappling with soaring energy prices due to the global energy crisis. This shielded French consumers and industries from the worst of the energy price spikes that contributed significantly to inflation elsewhere.

Additionally, the French government took proactive steps to limit the impact of rising costs through direct interventions such as price caps on energy and regulated tariffs, which helped control the cost of utilities for households. France also employed extensive subsidies and support measures to mitigate the cost of living increases, including financial assistance for fuel and food. These measures, while costly, helped to temper inflationary pressures by directly managing some of the biggest contributors to rising prices.

France's strong social safety net and regulatory environment, which includes significant market interventions, played a critical role in maintaining price stability relative to other economies. While these measures were not without their costs and consequences—such as increased government debt—they effectively insulated France from the sharper inflation spikes seen in other advanced economies, providing a unique example of how state intervention can shield an economy from global price volatility.

In France, the government often directly intervenes in the economy through price controls, subsidies, and strict labor regulations to maintain social stability and protect consumers from market volatility. For example, during recent global economic challenges, France capped energy prices, subsidized key industries, and provided direct support to households to shield them from inflationary pressures. This approach reflects a broader European tradition of prioritizing social welfare and economic stability over free-market dynamics.

In contrast, the U.S. economic system is grounded in principles of free-market capitalism, with a strong emphasis on individual enterprise, limited government intervention, and market-driven solutions. While the U.S. government does intervene during economic crises, the overall approach is to allow market forces to determine prices, wages, and resource allocation. This system is deeply rooted in the American values of individual freedom, entrepreneurship, and personal responsibility, fostering a dynamic and innovative economy that encourages competition and rewards risk-taking.

The U.S. system is often seen as better suited for America because it promotes higher economic growth, innovation, and job creation compared to more state-controlled models. The flexibility of the American labor market allows businesses to adapt quickly to changing conditions, driving economic dynamism and resilience. Moreover, the U.S. emphasis on personal freedom and limited government interference aligns with the cultural and historical values that define the nation, supporting an environment where individuals have the autonomy to pursue their economic interests.

While the French system may offer greater short-term stability during crises by protecting citizens from immediate economic shocks, it often comes at the cost of economic flexibility, higher taxes, and slower growth. The U.S. system, though sometimes exposing its citizens to greater market volatility, ultimately fosters a more adaptable, innovative, and prosperous economy, which aligns with American values of freedom and self-determination.

Trump’s Pitfall Laden Platform

The Trump platform, with its strong focus on protectionism, aggressive immigration control, and energy independence, poses several potential unintended economic consequences that could undermine its intended benefits. One key pitfall is the platform’s heavy emphasis on protectionist trade policies, such as high tariffs on foreign goods and withdrawing from international trade agreements. While these measures are intended to protect American jobs, they could lead to retaliatory tariffs from other nations, reducing market access for U.S. exporters and increasing costs for American consumers. This could result in higher prices for goods, disruptions in supply chains, and a potential trade war that could damage the global economy and harm U.S. industries reliant on exports.

Another significant risk comes from the platform's stance on aggressive immigration policies, including mass deportations and strict border enforcement. These policies could lead to a substantial reduction in the available labor force, particularly in sectors like agriculture, construction, and service industries, which are heavily reliant on immigrant labor. A sudden labor shortage will drive up wages, increase production costs, and ultimately contribute to higher prices for consumers. Moreover, the societal and economic costs of large-scale deportations could strain public resources, disrupt local economies, and contribute to long-term economic instability.

The platform’s push for energy independence through expanded fossil fuel production, while potentially lowering energy costs in the short term, could also have unintended economic consequences. By prioritizing fossil fuels over renewable energy sources, this approach risks sidelining investments in sustainable technologies, potentially leading to long-term economic disadvantages as the world shifts towards greener alternatives. Furthermore, the environmental impact of expanded drilling and reduced regulations could lead to increased health costs and environmental degradation, which would offset the immediate economic benefits of cheaper energy.

But wait. There’s more:

The Trump platform includes several elements that could potentially reduce the liberties of women and minorities, particularly in areas such as reproductive rights, gender equality, and educational freedoms. For example, the platform’s commitment to opposing abortion rights, supporting bans on taxpayer funding for gender transition procedures, and “keeping men out of women’s sports” directly targets the rights of women and transgender individuals. These policies restrict personal autonomy, limit access to essential healthcare, and enforce traditional gender norms, ultimately narrowing the scope of individual freedoms for affected groups. Such measures will create an environment where women's and minorities' rights are curtailed under the guise of protecting “traditional values,” thereby undermining progress toward greater equality for all.

Additionally, the platform’s stance on education threatens to diminish the representation and acknowledgment of minority experiences in schools. Cutting federal funding for schools that teach “controversial” subjects could lead to a homogenized educational system that excludes diverse perspectives, discouraging open dialogue about race, gender, and history. This approach not only marginalizes minority voices but also stifles the ability of future generations to critically engage with complex social issues. As a result, these policies could contribute to a cultural environment where the liberties and narratives of women and minorities are systematically diminished in public spaces, including schools, workplaces, and beyond.

But, But, But, What About Manufacturing Jobs

Under President Trump, American manufacturing saw a significant focus on reviving domestic industries, driven by policies aimed at reducing regulations, renegotiating trade agreements, and implementing tariffs on foreign goods to protect U.S. manufacturers. During the first three years of Trump's presidency, manufacturing jobs grew, with around 500,000 jobs added between 2017 and early 2020, marking a substantial rebound compared to previous years of stagnation. However, the COVID-19 pandemic in 2020 severely impacted manufacturing, leading to widespread job losses as factories shut down, supply chains were disrupted, and demand for certain goods plummeted.

In contrast, under President Biden, manufacturing jobs have continued to recover from the pandemic-induced downturn, with policies emphasizing investments in infrastructure, clean energy, and technology. The Biden/Harris administration has focused on initiatives like the CHIPS and Science Act, aimed at boosting semiconductor manufacturing, and the Inflation Reduction Act, which provides incentives for clean energy production and manufacturing within the United States. By mid-2024, manufacturing job numbers had rebounded to pre-pandemic levels, with gains driven largely by a push towards modernizing and “re-shoring” critical supply chains, particularly in high-tech and sustainable industries.

Going forward, the effectiveness of each administration’s approach in retaining and increasing manufacturing jobs will hinge on different strategies. Trump’s platform emphasizes traditional manufacturing through protectionist policies such as tariffs, rolling back regulations, and promoting fossil fuel industries. Such policies are designed to shield American industries from foreign competition and make the U.S. more self-reliant in key sectors. While these measures can provide short-term boosts to domestic manufacturing, they also risk retaliation from trade partners, increased production costs, and potential isolation from global supply chains, which could ultimately limit long-term growth opportunities.

On the other hand, Harris’ policies focus on innovation-driven manufacturing, with significant investments in infrastructure, clean energy, and advanced technologies like semiconductors and electric vehicles. These initiatives aim to modernize American manufacturing, reduce dependency on foreign sources for critical goods, and position the U.S. as a leader in emerging industries. By promoting sustainable practices and leveraging technological advancements, Biden’s approach seeks to future-proof American manufacturing against global economic shifts. However, challenges include the high initial costs of transitioning to greener technologies and the need for workforce retraining to align with new industry demands.

Overall, while Trump’s policies may offer more immediate, traditional manufacturing job protection, Harris’ forward-looking approach is likely better positioned to create sustainable, long-term job growth in modernized and technology-driven manufacturing sectors. The success of each strategy will depend on navigating global economic conditions, fostering innovation, and balancing short-term job retention with long-term industrial competitiveness.

Conclusion

As a Republican (and yes, I do know some of you think I am a RINO), I have always valued the principles of limited government, fiscal responsibility, and a strong national defense. However, when I look at the current landscape, it’s clear to me that Kamala Harris and the Democratic Party offer the United States a better path forward than Donald Trump. Trump’s platform, while appealing on the surface, is laden with economic pitfalls and a dangerous disregard for the democratic process. His attempt to weaponize economic issues like inflation to scare voters is nothing more than a cynical ploy, ignoring the broader global context that shapes our economic realities. While I have concerns about some of Harris’s economic policies, particularly the expansive government spending and regulatory approach, these issues are manageable compared to the existential threat Trump poses to our constitutional republic.

Inflation is a complex, global phenomenon, not merely the result of any single administration’s policies. By focusing solely on domestic inflation rates, Trump is misleading voters into believing that only his return to power can solve this issue. This narrative not only oversimplifies the problem but also distracts from the real work that needs to be done to navigate these global economic challenges effectively. The Biden/Harris administration has demonstrated a commitment to investing in America’s future through infrastructure, clean energy, and technology, creating the groundwork for long-term economic stability and growth. While no policy is perfect, the Biden/Harris approach reflects a balanced effort to address inflation without sacrificing the freedoms and values that define our nation.

What deeply concerns me about Trump is not just his economic policy but his blatant disregard for democratic norms and the rule of law. His refusal to accept the legitimate results of the 2020 election and his efforts to overturn the voice of the voters represent a direct attack on our constitutional republic. This behavior is not just troubling; it’s disqualifying. The strength of our nation lies in our commitment to free and fair elections, the peaceful transfer of power, and respect for the will of the people. Trump’s inability to uphold these fundamental tenets undermines the very fabric of our democracy and poses a far greater threat than any economic policy differences.

Trump’s habitual dishonesty, his unquenchable thirst for autocratic power, and his tendency to place his personal interests above the nation’s well-being make him unfit for office. His erratic behavior, disregard for the truth, and unwillingness to accept accountability create a volatile leadership style that threatens not only our domestic stability but also our standing on the world stage. By contrast, while I may not agree with every decision Harris makes, I believe she operates within the bounds of democratic governance and respects the institutions that safeguard our freedoms.

The choice before us is not just about economic policy but about the kind of leadership we want for our country. We need leaders who respect the rule of law, uphold democratic principles, and work towards solutions that benefit all Americans, not just those who support them politically. Kamala Harris, with her flaws and strengths, offers a vision rooted in governance, accountability, and respect for our democratic institutions. In contrast, Donald Trump’s continued threats to our constitutional norms and his dangerous pursuit of power make him an unacceptable choice. It’s time for all of us, regardless of party, to move beyond fear-mongering and to embrace leadership that truly represents the best of America.

My next column will be critical of Harris. However, I will offer such criticism as a fellow American not a foe. At the end of the day, even though the Russians, Chinese, and other adversaries want it to be true, we are bound by a Constitution that offers us the freedom to pick the person/people we feel will best take our grand American experiment forward to a brighter future. That act of choosing on our part, and the part of our fellow Americans does not make any of us evil or un-American. It’s kinda the whole point of this thing we have …