Broken: Our Free Market Capitalism

How Bailouts, Rent-Seeking, and Rigged Taxation Corrupted the American Dream

Introduction

The American economic system was built on the principle that risk and reward go hand in hand. Those who take risks in the marketplace—whether through investments, business ventures, or financial speculation—expect that when their bets pay off, they will be rewarded. But the other side of the equation is just as important: when those risks fail, the consequences should be borne by the risk-takers themselves. Over the last several decades, however, this fundamental principle of capitalism has been eroded. The ultra-wealthy, through a combination of political influence, regulatory capture, and government bailouts, have insulated themselves from the natural consequences of their decisions. Instead, they have socialized their losses, ensuring that taxpayers bear the burden of their failures while they continue to reap extraordinary rewards.

This distortion of market dynamics has created an economic system that no longer functions as a true free market. Instead of capital flowing to its most productive uses through competition and creative destruction, entrenched financial interests have secured a system in which profits are privatized, but risks are absorbed by the public. This has led to a massive and growing divide between the economic elite and the rest of society, with the middle class shouldering the costs of crises that they did not create. The government, rather than serving as an impartial referee ensuring fair competition, has instead become a mechanism through which the wealthiest individuals and corporations shield themselves from failure.

Part of this problem is a tax system that pits ordinary Americans against one another while allowing those with the means to afford top accountants, lobbyists, and financial loopholes to escape taxation. The reliance on income tax as the primary source of federal revenue not only exacerbates economic inequality but also fuels social division, as different segments of the workforce fight over who will foot the bill. Meanwhile, financial markets—where the vast majority of ultra-wealthy individuals derive their income—operate with little to no taxation, enabling the accumulation of vast fortunes with zero contribution to the public good.

This combination of corporate bailouts, rent-seeking behavior, and a deeply flawed tax system has created a crisis of moral hazard which threatens the long-term stability of the American economy; and, to a certain extent with the rise of the authoritarian left and right our very country. The solution is not more government intervention, but rather a return to the fundamental principles of free markets—where risk-takers must bear the full consequences of their actions. One way to restore this balance is through an automated transaction tax, which would shift the tax burden away from labor and onto speculative financial activity, reducing the incentives for rent-seeking behavior while ensuring that Wall Street pays its fair share. I’ve outline that proposal here; today’s piece is around how we got to where we are today.

The Normal Functioning of Markets: Risk, Reward, and Consequence

At its core, our innovation engine (known as capitalism) is a system that rewards innovation, risk-taking, and efficiency. Entrepreneurs and investors allocate resources to projects they believe will yield the highest returns, and in doing so, they help drive economic growth and prosperity. The fundamental principle behind this process is that those who take risks must also bear the consequences of those risks. If a business thrives, its owners and investors profit. If it fails, they lose their investments. This natural cycle ensures that capital is efficiently allocated, bad ideas are weeded out, and innovation is continuously rewarded.

Historically, markets have adhered to this logic. In the early 20th century, financial booms and busts operated under the assumption that reckless investors and firms that overextended themselves would face the full force of market discipline. For example, during the Great Depression (1929-1939), excessive stock speculation led to widespread financial collapse, wiping out fortunes but also teaching critical lessons about market stability. Similarly, in the Savings & Loan Crisis (1980s-1990s), hundreds of mismanaged banks went under, and many executives faced financial ruin or even criminal prosecution. These failures were painful, but they served as a crucial mechanism to ensure that irresponsible behavior was not rewarded and that future participants learned from past mistakes.

When markets function properly, those who gain the most during a boom should also lose the most in a bust. This natural corrective mechanism prevents reckless risk-taking by ensuring that excessive speculation has real and lasting consequences. During the dot-com crash of the early 2000s, many speculative internet startups collapsed, leading to huge financial losses for investors who had overvalued unprofitable companies. But the system worked as intended—firms that provided real value survived, while those that were built on hype alone vanished. The result was a stronger, more resilient tech industry that went on to produce the giants of today, such as Amazon and Google, which emerged from the ashes of the crash.

However, in recent decades, this balance between risk and reward has been systematically undermined. Instead of allowing market forces to determine winners and losers, the government has stepped in repeatedly to bail out large institutions, shielding them from the consequences of their decisions. This intervention has fundamentally changed the incentives that drive economic behavior. If major financial players know that they will be rescued no matter what, there is no reason for them to act prudently. The result is an economy where profits are privatized, but losses are socialized, leading to ever-riskier behavior and a growing disconnect between financial success and economic contribution.

The erosion of market discipline is not just an economic issue—it is a moral one. When individuals and corporations are rewarded for taking irresponsible risks while the public bears the costs, trust in the system collapses. The American economy was built on the idea that hard work and innovation lead to prosperity. But when some are allowed to gamble recklessly with impunity while others struggle under the weight of stagnant wages and rising costs, the very foundation of that promise is called into question.

Too Big to Fail: The Death of Moral Hazard

The concept of moral hazard—where individuals or firms take excessive risks because they believe they will be shielded from the consequences—has become deeply embedded in the American financial system. The phrase too big to fail entered the national lexicon during the 2008 financial crisis, when the government bailed out major banks and financial institutions under the pretense that their failure would trigger catastrophic economic consequences. While proponents of these bailouts argued they were necessary to prevent a complete collapse, the reality is that they removed a crucial pillar of free-market capitalism: the principle that reckless risk-taking leads to failure.

The 2008 bank bailouts marked a dramatic shift in economic policy. Instead of allowing firms that had engaged in irresponsible lending and speculative trading to face the consequences, the government injected $700 billion into failing institutions through the Troubled Asset Relief Program (TARP). Many of these firms, such as AIG and Citigroup, had knowingly engaged in high-risk mortgage-backed securities, earning billions in profits when the housing market was booming. Yet, when the market collapsed, they were rescued with taxpayer money. In a true free-market system, these institutions would have gone bankrupt, and their executives would have faced financial ruin. Instead, they received public funds, and many of their top executives continued receiving multi-million-dollar bonuses even after being bailed out.

The COVID-19 corporate stimulus in 2020-2021 further illustrated how the government continues to protect the financial elite at the expense of small businesses and ordinary workers. Under the guise of emergency economic relief, the Paycheck Protection Program (PPP) allocated trillions of dollars in aid, yet 82% of the program's funds ended up benefiting large corporations rather than small businesses. Major airline companies, for example, took massive government bailouts while still laying off thousands of employees. Meanwhile, millions of small businesses were forced to close, unable to access the same financial lifelines that were made available to the well-connected.

This dynamic has created a market where financial elites are not bound by the same rules as the rest of society. If an average American makes bad investments, they bear the full consequences—whether it's losing a house, going bankrupt, or facing unemployment. But if a major financial institution engages in reckless speculation, the government steps in to rescue them. This double standard has effectively eliminated the risk of failure for the wealthiest participants in the economy, leading to increasingly reckless financial behavior. Hedge funds and private equity firms now take on extreme leverage, knowing that if their bets pay off, they will profit immensely, and if they fail, they can rely on government intervention to cushion their losses.

This perversion of market discipline has long-term consequences for both the economy and public trust. Instead of capital flowing to the most productive uses, it is concentrated in speculative financial activity that contributes little to real economic growth. Bailouts distort competition, allowing entrenched financial interests to dominate markets without fear of failure. Meanwhile, the middle class—lacking access to the same safety net—bears the brunt of economic downturns, whether through job losses, inflation, or stagnant wages. If true market capitalism is to be restored, this system of corporate welfare must end.

Rent-Seeking and the Hijacking of Government

At the heart of America’s economic dysfunction is a system that no longer rewards productivity and innovation but instead prioritizes rent-seeking behavior—the practice of leveraging political influence to extract wealth without contributing value. In a functioning free market, businesses succeed by offering better products, improving efficiency, or meeting consumer demand. However, in the modern economy, the wealthiest individuals and corporations have discovered a far more lucrative strategy: using government power to protect their interests, secure subsidies, and limit competition. This behavior distorts market forces and undermines the very principles of capitalism.

One of the primary ways rent-seeking manifests is through corporate lobbying and regulatory capture. The largest firms in industries such as finance, pharmaceuticals, and technology spend billions of dollars annually to shape legislation in their favor. In 2022 alone, corporate lobbying expenditures exceeded $3.7 billion, with major industries ensuring that policies favored their interests rather than the broader economy. Wall Street, for example, has consistently fought against increased financial regulations that could prevent the kinds of excessive risk-taking that led to the 2008 crash. Instead of competing on a level playing field, these firms use their political influence to create regulatory loopholes that allow them to continue engaging in high-risk, high-reward behavior with little accountability.

This revolving door between Washington and Wall Street further entrenches rent-seeking behavior. Many former politicians and regulators—ostensibly responsible for ensuring fair competition—are quickly absorbed into the corporate world, where they leverage their government connections to benefit private interests. More than 50% of retiring members of Congress take lobbying or corporate advisory positions, ensuring that public policy remains skewed in favor of the financial elite. Meanwhile, regulatory agencies such as the SEC and the Federal Reserve are often staffed by former industry executives who are reluctant to impose rules that would curb the excesses of their former (and future) colleagues. This systemic corruption ensures that economic power remains concentrated in the hands of a few, further widening the gap between the wealthy and everyone else.

Another major tool of rent-seeking is government subsidies and corporate welfare, which transfer taxpayer money to already profitable industries under the guise of economic necessity. The financial sector, for example, has received trillions of dollars in direct and indirect support over the last two decades, from bailout funds to artificially low interest rates that inflate asset prices. Similarly, massive corporations in industries such as agriculture, oil, and defense benefit from billions in federal subsidies, allowing them to maintain market dominance while smaller competitors struggle to survive. These subsidies distort market competition and prevent the emergence of new players, ensuring that entrenched interests remain protected regardless of their efficiency or value creation.

The direct consequence of this rigged system is that the wealthy are no longer playing by the same rules as ordinary Americans. The top 1% of earners now control over 32% of national wealth, while the bottom 50% own just 2.5%. This isn’t because the ultra-rich are uniquely innovative or productive—it’s because they have manipulated the system to ensure that their wealth is never at risk. Instead of creating new industries or investing in innovation, many of the wealthiest individuals make their fortunes through financial speculation, tax loopholes, and government-backed protections. This growing disparity is not the result of free-market capitalism but rather the systematic erosion of market discipline.

If the economy is to be truly competitive again, rent-seeking behavior must be dismantled. This means ending regulatory capture, closing lobbying loopholes, and eliminating corporate subsidies that give large firms an unfair advantage. However, one of the most significant structural problems lies in the way the U.S. government collects revenue—through a tax system that disproportionately burdens ordinary Americans while allowing the wealthiest to escape their fair share.

How the Income Tax System Pits Americans Against Each Other While the Ultra-Wealthy Escape

The American tax system, designed in theory to fund public services and ensure a fair economic contribution from all, has instead become a tool that deepens inequality and fuels social division. The central problem is that the federal government primarily taxes income, even though income from wages represents a shrinking share of the total economic pie. Meanwhile, the ultra-wealthy derive their wealth primarily from capital gains, investments, and financial speculation, which are taxed at far lower rates or avoided altogether through legal loopholes. This imbalance has created a system in which working- and middle-class Americans fight over marginal changes in income tax policy, while billionaires, hedge funds, and multinational corporations operate in an entirely different financial universe—one where taxes are an afterthought, easily manipulated and minimized.

Politicians on both sides of the aisle have long used income tax policy as a political wedge issue, turning working Americans against each other while ignoring the structural advantages enjoyed by the ultra-wealthy. Conservatives argue that lowering income taxes benefits job creators, while progressives advocate for higher tax rates on the rich to fund social programs. But this debate largely misses the point—because neither policy addresses the reality that the truly wealthy do not derive their fortunes from taxable wages. While middle-class workers see a significant portion of their paychecks deducted for federal taxes, Social Security, and Medicare, billionaires like Jeff Bezos, Elon Musk, and Warren Buffett can take out low-interest loans against their assets and pay little to no income tax year after year.

The numbers are staggering. A 2021 ProPublica report revealed that some of the wealthiest Americans, including Musk and Bezos, paid a true tax rate of less than 3.4%—far lower than the tax rate paid by the average teacher, nurse, or construction worker. The reason? The current tax code prioritizes capital gains and investment income, which are taxed at a maximum of 20%, far lower than the 37% top marginal rate for earned wages. On top of that, loopholes such as carried interest (which allows hedge fund managers to classify earnings as capital gains), real estate depreciation deductions, and offshore tax havens enable the financial elite to further reduce their taxable income.

Aside: The ultra-rich (Elon Musk, Donald Trump, etc …) avoid taxable income by leveraging their assets—stocks, real estate, and businesses—as collateral for low-interest loans instead of selling them. Since loans are not considered taxable income, they can live tax-free while their wealth continues to grow. Instead of paying capital gains taxes on stock sales, they borrow millions at 1-3% interest rates, using the funds for expenses, investments, and even political influence. Upon their death, their heirs inherit the assets with a stepped-up cost basis, erasing any capital gains taxes permanently, allowing the cycle to repeat.

Regular Americans (you and I) can’t use this strategy because we don’t own enough appreciating assets, can’t access ultra-low interest rates, and must make loan payments from taxed income. While billionaires borrow at rates below inflation, middle-class individuals face 6-8% loan rates and must repay with after-tax earnings. Additionally, most Americans’ wealth is tied to their homes, which are not as easily leveraged as stock portfolios. Unlike the wealthy, who can roll over their loans indefinitely, ordinary borrowers face repayment obligations, and our gains are taxed immediately when we sell assets, unlike billionaires who escape taxation through inheritance loopholes.

Another reason to switch to the Automated Payment Transaction Tax (APTT). It offers a market-based solution that eliminates tax loopholes while ensuring everyone pays their fair share, including the ultra-wealthy who exploit asset-backed borrowing. By replacing income and payroll taxes with a flat 0.35% tax on all financial transactions, the APTT would capture revenue from stock trades, real estate deals, and billion-dollar financial maneuvers—ensuring that Wall Street, hedge funds, and high-net-worth individuals contribute proportionally to the system. This tax is automatically applied at the moment of any transaction, preventing billionaires from evading taxation through borrowing and inheritance schemes. Unlike the current tax system that burdens wage earners, the APTT would shift the tax base to where the real money moves—financial markets—without loopholes, deductions, or political manipulation.

Meanwhile, for ordinary Americans, tax burdens have only grown. The bottom 50% of wage earners now contribute more in total payroll taxes than the top 1% do in income taxes. At the same time, corporate tax revenues have declined dramatically as a share of GDP, despite record corporate profits. In 2020, more than 55 of the largest U.S. corporations paid zero in federal taxes, even as they reported billions in earnings. The burden of funding public services falls increasingly on workers and small businesses, while multinational corporations and Wall Street firms benefit from tax breaks written into law by the very politicians they fund.

The most insidious consequence of this whole system is that it diverts attention away from the real problem. By structuring taxation around wages, the government forces different income groups to fight over who should pay more, while the wealthiest Americans quietly avoid taxation altogether. The working class is told to resent the middle class for “not paying their fair share,” and the middle class is told to resent the poor for receiving government assistance. All the while, the billionaires who manipulate financial markets, extract wealth through rent-seeking, and benefit from government bailouts continue to accumulate massive fortunes without any real accountability.

To fix this imbalance, the tax system must be fundamentally restructured so that it does not pit Americans against each other while leaving financial elites untouched. One of the most effective ways to do this would be to shift taxation away from income and onto financial transactions, ensuring that those who profit most from speculation and rent-seeking finally contribute their fair share.

The Case for a Transaction Tax to Reduce Rent-Seeking Behavior

If the American tax system is to be reformed in a way that restores fairness, eliminates rent-seeking behavior, and removes the distortions that pit different income groups against each other, we must rethink the way we collect federal revenue altogether. Instead of relying on an income tax that can be gamed by the ultra-wealthy while disproportionately burdening wage earners, a far more effective approach is an Automated Payment Transaction (APT) Tax—a micro-tax on all financial transactions that ensures those who extract the most value from the system contribute their fair share.

Under the APT Tax model, every transaction—whether a paycheck deposit, a stock trade, a real estate purchase, or a billion-dollar derivative deal—would be subject to a small, flat tax rate of 0.35% from both the buyer and the seller. This structure ensures that those who engage in high-frequency trading, speculative financial activity, and rent-seeking behavior contribute meaningfully to government revenue. Additionally, anyone attempting to withdraw money in cash (effectively exiting the financial system) would be required to pay both the buyer and seller’s share of the tax, preventing large-scale tax avoidance.

The now defunct The Transaction Tax website used to offer the following as examples:

If you can do basic math, you can see that the revenue potential of this system is massive. The total volume of financial transactions in the U.S. economy is estimated to be in the quadrillions of dollars annually, with global derivatives markets alone seeing hundreds of trillions in transactions per year. Even with conservative estimates, assuming $5 quadrillion in annual transactions in the U.S. economy, a 0.35% tax on both parties in every transaction would generate approximately $17.5 trillion per year—enough to completely replace income taxes, payroll taxes, and corporate taxes while still leaving ample funding for public services.

One of the most powerful aspects of the APT tax is that it eliminates tax avoidance entirely. Unlike the current system, which allows corporations to use loopholes and offshore havens to shield profits from taxation, a micro-transaction tax applies to every financial movement—whether it's a hedge fund executing a high-frequency trade, a billionaire shifting money between investment accounts, or a corporation issuing bonds. No accountant or lobbyist can game this system because the tax is automatically applied to every transaction at the moment it occurs.

Furthermore, an APT tax would have profound effects on financial stability by discouraging excessive speculation and short-term, high-frequency trading (HFT), which currently dominates Wall Street. Right now, a significant portion of stock market activity is driven not by genuine investment but by algorithms executing thousands of trades per second to exploit minute price differences. These trades generate no real economic value, yet they extract billions from financial markets while contributing to volatility. A small transaction tax would disincentivize these forms of parasitic trading, making markets more stable and ensuring that long-term investors, rather than speculative traders, drive financial activity.

The key to implementing such a tax successfully is ensuring that every single transaction is taxed without exception—including those conducted by banks, hedge funds, and multinational corporations. Many critics of transaction taxes argue that they would disproportionately impact middle-class Americans making everyday purchases. However, because the APT tax replaces income taxes, payroll taxes, and most other federal taxes, the average American would see a massive increase in take-home pay, offsetting any small cost incurred from the tax itself. Additionally, because the tax applies proportionally to all transactions, the burden falls heaviest on those who engage in the highest volume of financial activity—namely, Wall Street firms and corporations, who currently pay little in taxes despite conducting trillions in financial transactions annually.

An APT tax would restore fairness to the economy, shift the tax burden away from workers, and ensure that those who extract the most from financial markets contribute accordingly. By removing the incentive for rent-seeking behavior and financial speculation while eliminating tax loopholes, this system would fundamentally restructure the U.S. economy in a way that aligns with free-market principles—ensuring that risk and reward are fairly distributed across all participants.

Next we should consider the impact of this rent-seeking economy on the middle class and how decades of financial favoritism have eroded the economic foundation of most Americans.

The Impact on the Middle Class: The Vanishing American Dream

For much of the 20th century, America’s economic strength was built on the foundation of a robust and growing middle class. Hard work, personal responsibility, and participation in a free market economy allowed ordinary people to build wealth, own homes, and achieve financial security. The post-World War II economic boom, combined with a fairer tax system and a strong industrial base, created an era in which economic mobility was a defining feature of American life. However, over the past several decades, a combination of financial deregulation, corporate bailouts, rent-seeking behavior, and an unfair tax structure has systematically dismantled this foundation, leaving middle-class families struggling while the ultra-wealthy amass unprecedented wealth.

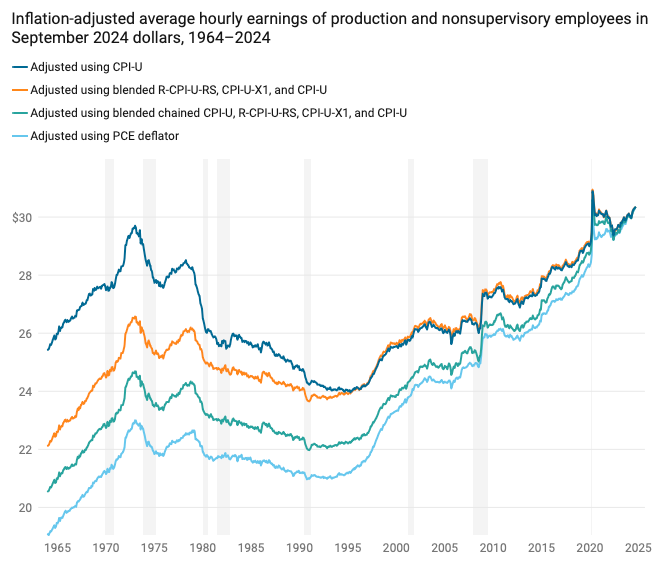

One of the most telling signs of middle-class decline is wage stagnation. While worker productivity has increased significantly over the last four decades, real wages for most Americans have barely budged. Inflation-adjusted wages have grown by just 17% since 1980, while CEO compensation has skyrocketed by over 400% in the same period. The gap between the rich and the rest has widened not because of merit or innovation but because financial elites have rigged the system in their favor. The erosion of labor protections, offshoring of jobs, and financialization of the economy have funneled wealth upward, leaving the middle class behind.

At the same time, the costs of middle-class essentials—housing, healthcare, and education—have risen dramatically, far outpacing wage growth. Homeownership, once considered a cornerstone of the American Dream, has become increasingly out of reach for younger generations. In the 1970s, the median home price was approximately 2.5 times the median household income; today, that ratio has ballooned to nearly 5.6 times income in many parts of the country. Student loan debt has surpassed $1.7 trillion, placing an enormous financial burden on young workers before they even have a chance to build wealth. Healthcare costs continue to rise, with the average family spending over $22,000 annually on premiums and out-of-pocket expenses, a figure that would have been unthinkable just a few decades ago.

The middle class is also increasingly vulnerable to economic downturns, while the ultra-wealthy remain insulated from market fluctuations. When a financial crisis occurs, workers face layoffs, declining wages, and foreclosures, while the wealthy use their assets to weather the storm. The 2008 financial crisis wiped out more than $19 trillion in household wealth, with middle-class families bearing the brunt of the losses. In contrast, Wall Street firms that helped create the crisis were bailed out and quickly returned to record profits. More recently, during the COVID-19 pandemic, millions of small businesses were forced to close, yet billionaires collectively added more than $5 trillion to their wealth, thanks to a combination of government stimulus and Federal Reserve policies that disproportionately benefited asset owners.

The growing wealth gap is not just an economic issue—it is a threat to the long-term stability of American democracy. When people feel that the system is rigged against them, they lose faith in institutions, leading to increased polarization and political extremism. History has repeatedly shown that rising income inequality precedes major social upheaval. The Gini coefficient, a measure of economic inequality, is now at its highest level since the Great Depression. Societies that allow extreme wealth disparities to persist—without mechanisms to ensure fair competition and economic mobility—inevitably face instability, resentment, and political disillusionment.

A strong middle class is essential for a thriving democracy and a stable economy. It fosters entrepreneurship, consumer spending, and upward mobility. But if current trends continue, America will increasingly resemble a two-tiered society, where a wealthy elite controls the vast majority of resources while the rest struggle to keep up. This is not capitalism in its true form—it is a distortion caused by government favoritism, corporate welfare, and an outdated tax system that punishes labor while rewarding financial speculation.

To reverse this decline, the system must be realigned to restore fairness, competition, and opportunity. That means ensuring that the wealthiest individuals and corporations bear their fair share of taxation, reducing speculative financial activity, and re-establishing a market economy where success is determined by innovation and productivity rather than political connections and government bailouts. Just in case you are worried that this is some whacked out ultra liberal socialist drivel, I will now make a conservative, market-based argument for why addressing income inequality is not just a moral imperative but a necessity for the long-term survival of the American experiment.

The Conservative Market-Based Case Against Rising Inequality

A core tenet of free-market capitalism is that competition drives innovation, rewards hard work, and ensures that resources flow to their most productive uses. True conservatives believe in a system where individuals succeed based on merit, where businesses thrive by serving their customers, and where the government’s role is to enforce fair rules rather than pick winners and losers. However, the reality of today’s economy is far from this ideal. Rising income inequality is not just a social issue—it is a fundamental threat to the principles of capitalism and long-term economic stability.Conservatives who value economic dynamism, entrepreneurship, and market competition should be deeply concerned about how growing inequality is distorting incentives, concentrating power, and undermining the very foundations of a prosperous society.

Markets Require Competition, Not Corporate Favoritism

Free markets thrive when businesses must compete on a level playing field. However, rising income inequality is increasingly the result of crony capitalism rather than genuine competition. When corporations and financial elites use their wealth to influence government policy—whether through corporate bailouts, tax loopholes, or regulatory capture—they create an unfair advantage that distorts markets. The principle of creative destruction, which ensures that failing businesses make way for better ideas, is no longer functioning properly because politically connected firms are shielded from failure. Instead of allowing competition to drive innovation, government interventions prop up entrenched interests while smaller, more innovative competitors are squeezed out.

A healthy market economy requires a system in which businesses rise and fall based on merit. Yet, as the 2008 financial crisis demonstrated, the largest firms can engage in reckless behavior without fear of consequences, knowing that the government will step in to save them. This is not capitalism—it is corporate socialism. Conservatives should be at the forefront of efforts to eliminate government-granted privileges that distort competition, break up monopolistic power, and restore a market where businesses succeed by delivering value, not by leveraging political influence.

Rising Inequality Stifles Economic Growth and Social Stability

Many on the right argue that income inequality is a natural byproduct of capitalism, reflecting the rewards of hard work and innovation. However, extreme inequality—especially when driven by rent-seeking rather than productive economic activity—can undermine the very system that conservatives seek to defend.

A highly unequal society reduces economic dynamism because it limits the ability of new businesses and entrepreneurs to enter the market. In a system where capital is increasingly concentrated at the top, middle-class consumers have less disposable income to drive demand, which in turn reduces the incentive for businesses to invest and expand. This dynamic leads to slower economic growth and reduced opportunity, making it harder for hard-working Americans to achieve upward mobility.

Additionally, history has repeatedly shown that widening income disparities lead to political and social unrest. The economic instability of the late 19th century “Gilded Age” led to mass populist movements, while the extreme inequality of the 1920s preceded the Great Depression. Even today, we see growing political polarization fueled by a sense that the economic system is rigged. When the middle class is squeezed and economic opportunity declines, it breeds resentment and division—conditions that pave the way for reactionary populism, state interventionism, and political extremism. True conservatives should be concerned that unchecked inequality can eventually lead to demands for radical economic policies that undermine free-market principles altogether.

A True Market-Based Approach: Ending Financial Favoritism and Shifting the Tax Burden

The solution is not big-government redistribution or wealth confiscation but rather structural reforms that restore fair market competition and eliminate government distortions. The best way to reduce harmful inequality is to end corporate bailouts, eliminate tax loopholes, and ensure that financial speculation contributes its fair share to the economy.

One of the most market-oriented ways to achieve this is by replacing the current income tax system with an Automated Payment Transaction (APT) tax, as discussed in the previous section. By taxing all financial transactions at a small, flat rate, this system would ensure that Wall Street, hedge funds, and high-frequency traders pay a proportional share, rather than allowing them to amass wealth without contributing meaningfully to society. Unlike traditional taxation, which punishes labor and productivity, a micro-transaction tax would primarily impact those engaging in high-volume, rent-seeking financial activities—exactly the kind of behavior that distorts markets and concentrates wealth without creating real value.

Furthermore, conservatives should advocate for stronger enforcement of antitrust laws, ensuring that large corporations cannot use their market dominance to stifle competition. Free markets do not function properly when a handful of firms control entire industries, dictating prices and wages without fear of competition. Breaking up monopolistic power is not anti-capitalist—it is a necessary step to restore competition and prevent artificial market distortions that benefit only a select few.

The Conservative Case for a Thriving Middle Class

A strong middle class is not just a political talking point—it is the backbone of a stable economy. Conservatives often emphasize the importance of self-reliance, hard work, and personal responsibility, but these values cannot flourish in an economy where middle-class wages are stagnant, housing is unaffordable, and financial success is increasingly determined by wealth inheritance rather than individual effort.

For capitalism to function as intended, everyone must have a fair chance to succeed. That means ensuring that markets are competitive, that workers receive a fair share of the value they help create, and that financial elites cannot extract wealth without consequences. A system where the ultra-rich can take excessive risks with no fear of failure while the middle class bears all the costs is not capitalism—it is feudalism disguised as free enterprise.

Conservatives must recognize that if we fail to address rising inequality, the alternative will not be more free-market capitalism but rather growing calls for heavy-handed government intervention, wealth taxes, and centralized control of the economy. The best way to preserve economic liberty is to ensure that capitalism works for everyone, not just those with the resources to buy political influence.

Conclusion

In every great turning point in American history, we have been tested—not by external enemies alone, but by the weight of our own contradictions. Today, we stand at such a moment. Our economic system, once the engine of broad prosperity and national strength, has been hijacked by those who seek to extract wealth rather than create it. The dream of a free and fair market, where competition drives innovation and effort is rewarded, has been replaced by a system of favoritism and financial manipulation. We have allowed a privileged few to amass fortunes without consequence, while the vast majority of hardworking Americans struggle under the weight of stagnant wages, rising costs, and a tax system designed to divide rather than uplift.

This is not the America that generations before us fought to build. This is not the nation that rose from the fires of revolution, defended democracy against tyranny, and expanded opportunity to each new generation. We were never meant to be a country where wealth alone dictates the rules, where government serves as the shield for the powerful instead of the safeguard of the people. Yet here we are, in a moment of rising inequality and declining faith in our institutions, where both the far left and far right exploit public anger to justify their own versions of authoritarian populism. They do not seek solutions; they seek control. They do not seek justice; they seek retribution. And in the absence of a functioning market that rewards merit and innovation, the bullies have taken the megaphone.

But America is not a nation built on surrender. We have, in our darkest hours, proven that we can still be a people governed by reason, bound by principle, and moved by compassion. We have overcome crises far greater than this one, and we will overcome this, too—not through more division, but through the difficult work of restoring fairness to our markets and accountability to our institutions. We must reject the false choice between unfettered greed and government control, between economic stagnation and reckless intervention. The answer is not found in slogans, but in action:

We must end corporate welfare and rent-seeking, ensuring that those who take risks bear the consequences of failure.

We must replace a tax system that pits Americans against each other with one that ensures everyone, especially those who extract the most from financial markets, contributes their fair share.

We must break the monopolies and distortions that stifle competition, restoring true free enterprise where innovation, not political influence, determines success.

This is not just an economic imperative—it is a moral one. A market that no longer rewards hard work is a market that breeds resentment. A system that concentrates power in the hands of a few, while leaving the many behind, is a system that invites revolt. If we allow the corruption of our economy to continue unchecked, we will not merely lose our prosperity—we will lose the very foundation of our democracy.

Abraham Lincoln, in the midst of America’s greatest trial, spoke of a new birth of freedom—a renewal of our highest ideals, not just for ourselves, but for those who would come after us. That is our charge now. We owe it to our children, and their children, to leave behind an America where markets are fair, opportunity is real, and government serves the people rather than the privileged few.

This fight will not be won by anger. It will be won by those who still believe in justice and accountability. It will be won by those who refuse to give in to cynicism and despair. It will be won by those who act—not out of hatred, but out of hope.

The road ahead is uncertain, but the duty before us is clear. Let us not be the generation that allowed the American experiment to wither under the weight of corruption and greed. Let us be the generation that reclaimed it. That stood up, against all odds, and said enough—and in doing so, ensured once again that government of the people, by the people, and for the people shall not perish from this earth.

This is very interesting. Thanks.